FINANCE CASE STUDY

Reducing Loan Default Risk with Predictive Analytics

Leveraging Machine Learning to enhance risk assessment and minimize losses for a leading financial institution.

The Client

Major National Bank

Industry: Financial Services

A well-established bank facing increasing pressure to improve the accuracy of their loan risk assessments amidst growing competition.

The Challenge

The client's existing rule-based system for evaluating loan applications was becoming less effective, leading to higher-than-desired default rates and missed opportunities with creditworthy applicants who were borderline.

- Inaccurate risk assessment leading to financial losses.

- Inability to identify subtle patterns indicating default risk.

- Potential bias in the existing manual or rule-based processes.

- Slow processing times for complex loan applications.

Our AI-Powered Solution

Businesses Alliance developed and deployed a custom Machine Learning model to predict the likelihood of loan default with significantly higher accuracy. Key components included:

- Data Integration & Preprocessing: Securely aggregated data from various internal sources (transaction history, credit reports, application details) and cleaned/prepared it for modeling.

- Feature Engineering: Identified and created new predictive features from the raw data that captured subtle behavioral patterns.

- Advanced ML Algorithms: Utilized ensemble methods (like Gradient Boosting Machines) trained on historical loan performance data.

- Explainable AI (XAI): Incorporated techniques to understand model predictions, ensuring transparency and compliance.

- MLOps Pipeline: Built a robust pipeline for model retraining, deployment, and monitoring to maintain performance over time.

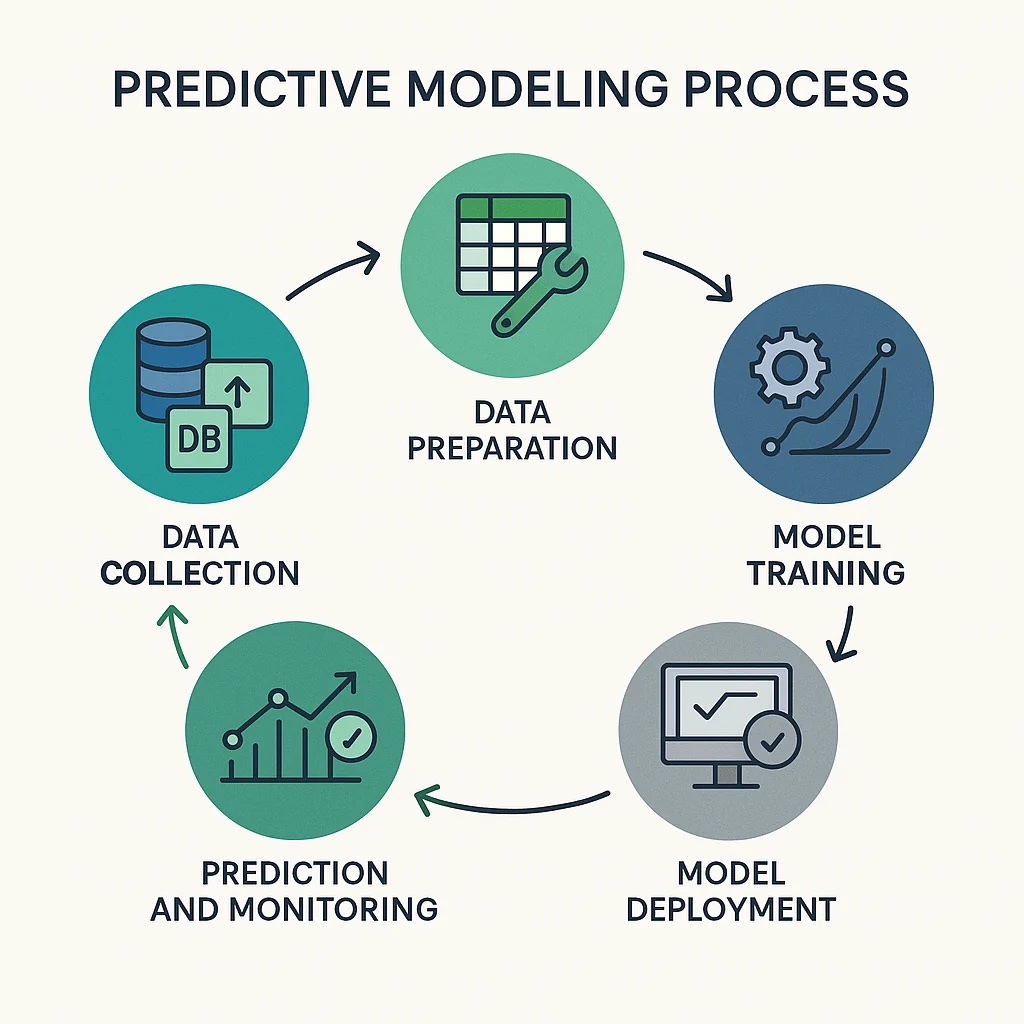

Conceptual diagram of the predictive modeling process.

Implementation Journey

Phase 1: Discovery & Data Assessment

Collaborated with client stakeholders to define objectives, assessed data availability and quality, and established success metrics. (Weeks 1-2)

Phase 2: Model Development & Validation

Developed initial models, performed rigorous cross-validation, engineered features, and selected the best-performing algorithm. (Weeks 3-8)

Phase 3: Integration & MLOps Setup

Integrated the model into the client's systems via API, set up monitoring dashboards, and established the automated retraining pipeline. (Weeks 9-12)

Phase 4: Pilot & Rollout

Conducted a pilot program in a specific department, gathered feedback, made final adjustments, and proceeded with a phased rollout. (Weeks 13-16)

Quantifiable Results

Improvement in Default Prediction Accuracy

Before vs. After Accuracy

Reduction in Actual Loan Defaults (YoY)

Year-over-Year Default Rate

Faster Loan Application Processing Time

Average Processing Time