FINANCIAL SERVICES CASE STUDY

AI-Powered Risk Assessment

Transforming credit risk analysis with Generative AI for faster, more accurate decisions.

The Client

Regional Banking Institution

Industry: Financial Services

A mid-sized regional bank with over $15 billion in assets, serving both consumer and commercial clients across multiple states, seeking to modernize their credit risk assessment process.

The Challenge

The client was facing increasing pressure from fintech competitors and needed to improve their loan approval process, which was slower and less accurate than desired. Their traditional credit scoring system relied too heavily on limited financial metrics while overlooking valuable unstructured data.

- Average loan application processing time of 5-7 business days, causing customer frustration.

- Default rate of 4.2%, above their target threshold of 3.5%.

- Inability to effectively analyze unstructured data from financial statements, business plans, and market reports.

- Limited automation in the credit analysis workflow, requiring extensive manual review.

Our AI-Powered Solution

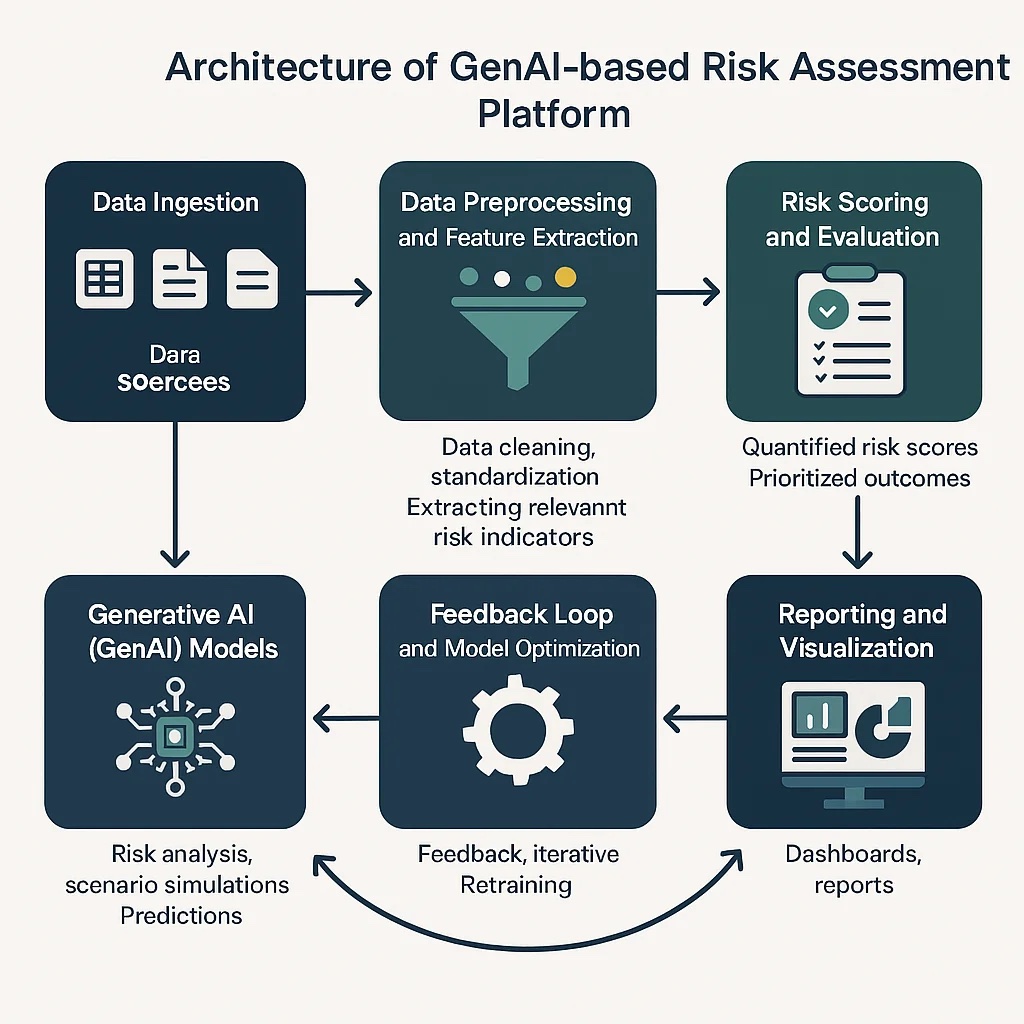

Businesses Alliance implemented a comprehensive Generative AI solution for risk assessment that integrated both structured and unstructured data analysis. Our platform extracted valuable insights from text-heavy documents while maintaining regulatory compliance and auditability.

- Document Intelligence Engine: Utilized large language models to extract, categorize and analyze information from financial statements, business plans, and industry reports.

- Multi-modal Risk Assessment: Combined traditional financial metrics with insights from unstructured data to create a more comprehensive risk score.

- Explainable AI Framework: Provided clear reasoning behind credit decisions with specific document citations to maintain regulatory compliance.

- Automated Reporting: Generated detailed risk assessment reports that highlighted key factors influencing the credit decision.

- Integration with Legacy Systems: Seamlessly connected with the bank's existing core banking platform and loan origination system.

Conceptual architecture of the GenAI risk assessment platform.

Implementation Journey

Phase 1: Requirements & Compliance

Conducted comprehensive stakeholder interviews and regulatory compliance assessment to establish project parameters. (Weeks 1-4)

Phase 2: Model Development

Built and fine-tuned language models for financial document analysis, created integrated risk scoring system. (Weeks 5-12)

Phase 3: Systems Integration

Connected the AI platform to existing banking systems, ensured secure data flow, and implemented audit trails. (Weeks 13-18)

Phase 4: Validation & Deployment

Conducted rigorous testing with historical data, performed model validation, and implemented a phased rollout beginning with commercial loans. (Weeks 19-24)

Quantifiable Results

Reduction in Processing Time

From 6 days to less than 2 days on average

Reduction in Default Rate

From 4.2% to 3.3%

Increase in Loan Portfolio

Year-over-year growth